A pawn loan is a loan contract in which the pawnbroker offers a loan to the customer and takes items of customer’s personal property as collateral.

It does not require any complicated examinations or documents as a bank loan does, and we do not collect loans in a forcible manner as some consumer finance businesses do.

As long as the contract period is not expired, the customer can redeem the pawned item anytime. When it is difficult for the customer to repay the loan within the period, the loan period can be extended. When you are suddenly in need of money, or you cannot ask for help from your family or friend about money problems, pawn loan might be the right solution for you. We are happy to be of service to you.

Information about Pawn Loans

Interior of the shop

Process of Pawn Loan Contact

■ Appraisal of items

When you bring an item for a pawn loan, we appraise the item, including the validity of the item as collateral. The amount of loan is determined based on the current trends of exchange rate, market prices, and the latest data of the bid prices in major auctions in Japan that we have collected in our shop. You do not necessarily have to borrow the full amount of loan that we offer. You can determine the loan amount yourself within the offered amount, so that you do not have to warry about the excessive amount of loan.

- If the appraisal price does not meet your expectation, you can cancel the transaction.

- Since we do not charge any fees for the appraisal service, feel free to visit our shop.

■ A form of identification is required for a contract of pawn loan.

When you agree on the offered amount of loan, we must ask you to show us a form of identification to confirm your identity.

- We are required to confirm your identity with a form of identification issued from a public institution. (driver’s license, passport, residence card, etc.)

- We do not accept “My-Number Card” as a form of identification.

- An expired form of identification cannot be used for identity confirmation.

- Anyone who is 18 years old or older (excluding high-school students) and not declared as an adult ward, incompetent, or quasi-incompetent is eligible for pawn loans.

- Under the organized crime exclusion ordinance of Gunma Prefecture, we do not conduct any transaction with people related to organized crime.

- Identity confirmation is not necessary for the second and following transactions. (If your name or address has been changed or few years have passed from your last transaction, reconfirmation of your identity is required.)

■ When the pawn loan contract is finalized, we hand you a pawn ticket (exchange ticket) in exchange for the item.

We hand you a pawn ticket (exchange ticket) and the money in cash on the spot in exchange for the item to be pawned. The pawn ticket is necessary to redeem your item or to extend the loan period. Also, since important information is written on the pawn ticket, such as the name of the customer, amount of loan, etc., please keep the ticket securely so as not to lose it.

- We do not reissue the pawn ticket. If you lost the pawn ticket, please contact us immediately in order to prevent troubles from happening.

- Since we will never contact to remind you of the due date, please be sure not to forget the loan period, etc.

- Once the loan period is over, the ownership of the item is moved from you to us, and the pawn loan contact expires. When this happens, we can no longer return the item to you.

Note

- In accordance with the criteria of our shop, we may not be able to offer loans for some items. Refer to “Items for Transactions” for details.

- The pawn loan contracts can be concluded in the shop only.

Process after Conclusion of Pawn Loan Contract

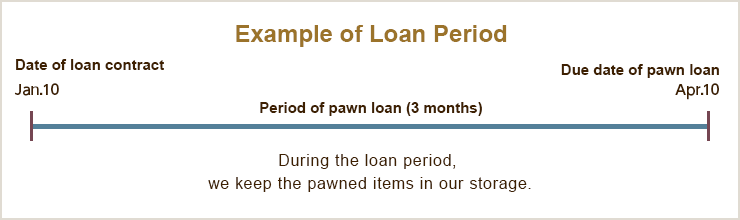

■ Due date of pawn loan

- The first storage period of the pawned item is three months. If you fail to repay the full amount of loan and the pawning fee, or pay the pawning fee to extend the loan period before the due date, we will dispose of the pawned item.

- As long as the loan period is not over, the pawned item can be redeemed anytime. * Holidays and closed hours are excluded.

- If you cannot pay the loan back within the period, the period can be extended by paying the pawning fee.

- If the due date happens to fall on a regular or temporary holiday, the due date is automatically postponed to the next business day.

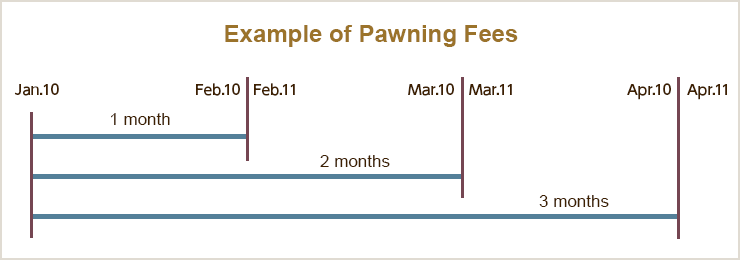

■ Pawning fee (storage fee for the pawned items)

- The pawning fee for one month applies to the period from the date of contract to the same day in the next month. When the first month has past even for a day, the pawning fee for two months is required. If the last day of the month happens to fall on a regular or temporary holiday, the due date of the month is postponed to the next business day.

- The pawning fees are not calculated based on the number of days.

- In accordance with the Pawnbroker Business Act, the pawning fee for one month will be set in the range from 3 to 7%.

- The pawn fees of our shop are determined in accordance with Article 36 of the Pawnbroker Business Act.

■ Extension and renewal of pawn loan period

- When the pawn fee for the past months is paid by the due date of loan period, the period can be extended.

- In principle, pawning fee for three months is necessary to extend the loan period. However, we accept payments for a minimum of one month to suit your convenience.

- We do not contact to remind you of the due date of loan period. Please be sure not to forget to make the payments.

- Even if the due date has passed, we may still have the pawned item in our shop for a few days. Therefore, please call us to check whether your item is still here.

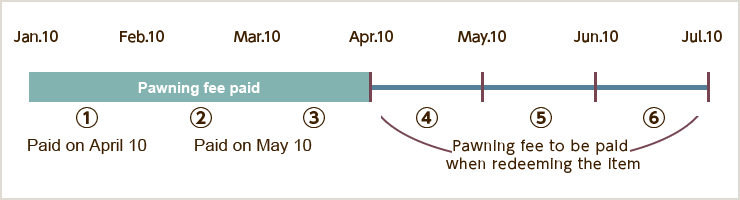

Flow of Pawn Loan from Contract to Repayment

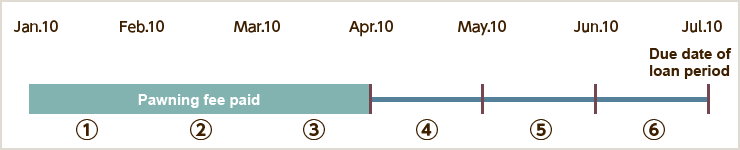

By using figures and texts, the flow of pawn loan is explained below in an easy-to-understand manner. Please refer to the followings as a guidance of pawn loans.

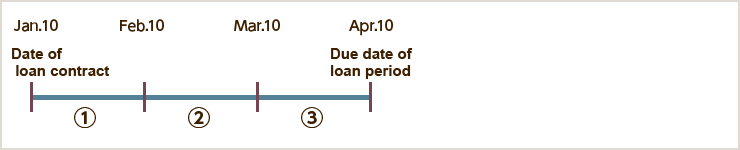

■ The first loan period is three months.

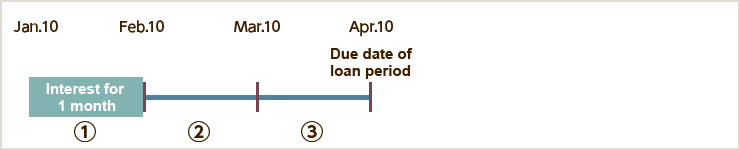

Since the customer was not able to repay the loan by the first due date, he came to the shop on April 10 and paid the pawning fee for one month of Period (1). By this payment, the loan period was extended to May 10.

■ ■ Payment was made for Period (1).

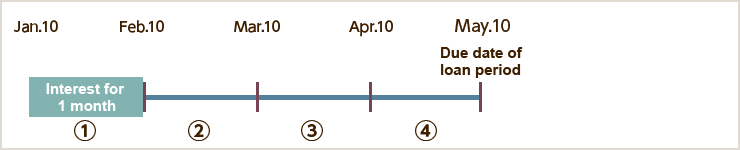

■ The due date of loan period was postponed as shown below.

The customer was not able to repay the loan again by the due date May 10, and he came to the shop on May 10 and paid the pawning fee for two months of Periods (2) and (3) to extend the loan period. This time, the due date was postponed to July 10.

■ ■Payment was made for Periods (2) and (3).

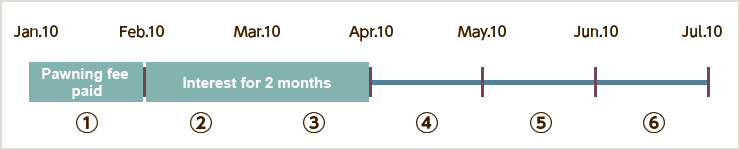

■ The due date of loan period was postponed as shown below.

On July 10, the customer was able to repay the full amount of loan. He came to the shop and repaid the loaned money and the rest of the pawning fee to redeem his item. The pawning fee paid at this time was the fee for three months of Periods (4), (5), and (6).